- From Saudi Arabia to Morocco, and from intelligent savings to Arabic AI—here are the top deals and ecosystem moves between July 13–20, 2025

- A Packed Week Kicks Off Q3: Strategic Funding and Innovation on the Rise

This report, published by EntArabi, is part of a series tracking innovation and investment across the region. It covers the period from July 13 to July 20, 2025—the opening days of Q3.

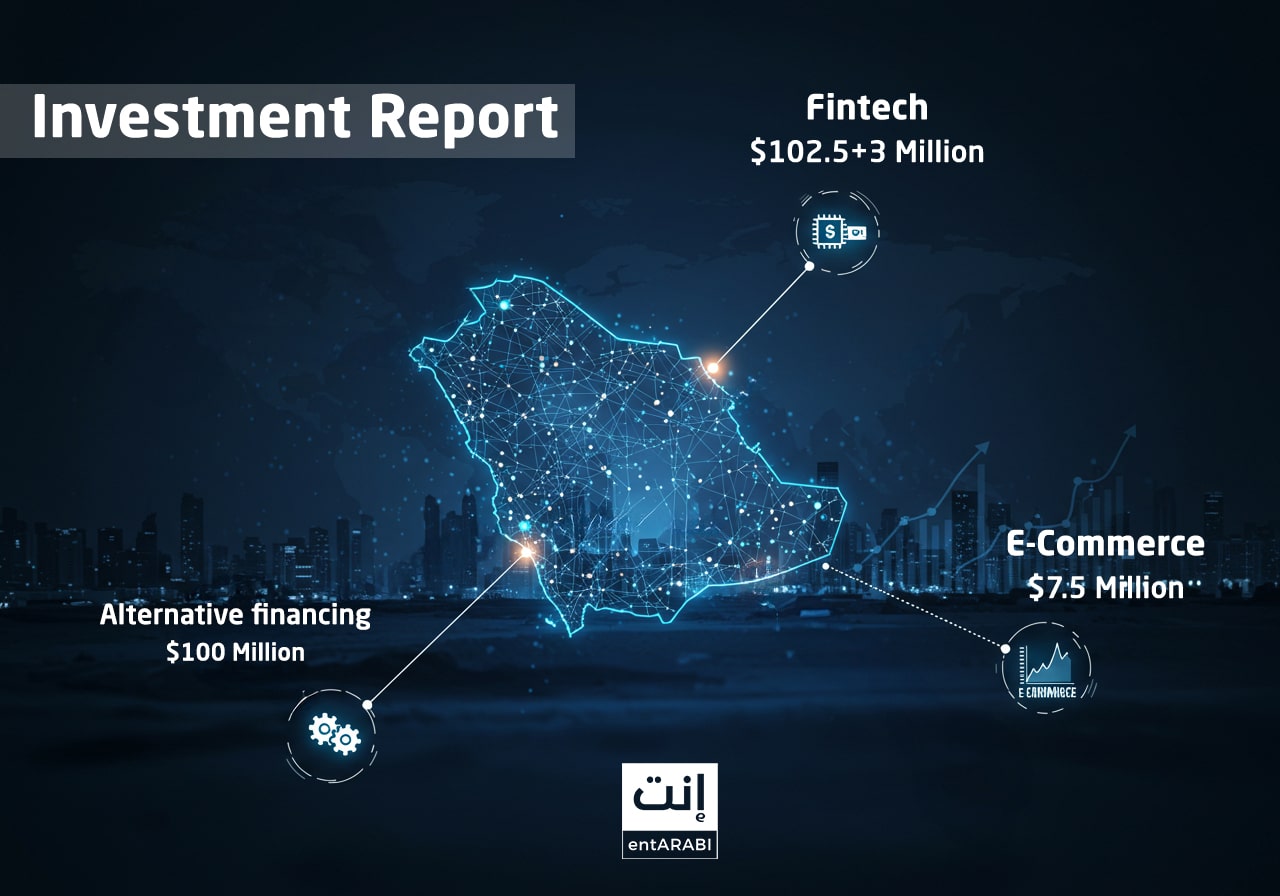

During this week, startup activity surged across key MENA markets, particularly in fintech, artificial intelligence, alternative finance, and e-commerce. Saudi Arabia stood out as the most active country, both in terms of deal volume and initiative diversity.

The Numbers: Weekly Overview

| Country | Deals / Initiatives | Estimated Value | Key Sectors |

| Saudi Arabia | 3 | $102.5M+ | Fintech, AI, Alternative Finance |

| Egypt | 1 | Several million dollars | Fintech – Smart Saving |

| Morocco | 1 | $7.5M | E-commerce, Digital Payments |

| Lebanon | 1 (media initiative) | Not yet funded | Entrepreneurial Media |

| USA (reference) | 1 | $100M | Paid Content – Digital Media |

Saudi Arabia Leads: Strategic Funding and Accelerators in Line with Vision 2030

- Alinma Bank and Falak Investment Hub launched the AmadTech accelerator, targeting:

- 20 fintech startups and 15 intellectual properties.

- Aimed at driving digital transformation in finance, with support from Fintech Saudi and Mawhiba.

- ai, a Saudi-based AI company, raised $1.5M in a pre-seed round:

- To advance Arabic conversational AI covering more than 25 dialects.

- The startup is headquartered in Riyadh with offices in Dubai and Cairo, serving both public and private sector clients.

- Sukna Capital launched the region’s first Shariah-compliant direct lending fund:

- Targeting over $100M in assets.

- Aims to provide non-dilutive financing to SMEs using asset-backed credit.

- The move responds to a gap in SME lending, which accounts for only 1% of total bank credit in Saudi Arabia—far below the Vision 2030 target of 20%.

Egypt Bets on Smart Saving and a Digitally Fluent Generation

- Palm, a goal-based savings platform, raised a multi-million-dollar round:

- Led by 4DX Ventures and joined by Plus VC.

- Offers smart investment tools across fixed income, equities, and precious metals.

- Plans to expand across Mediterranean markets.

- Focuses on building healthy financial habits and democratizing saving.

Morocco Strengthens Its E-commerce and Digital Payments Infrastructure

- ORA Technologies closed a $7.5M Series A round led by Azur Innovation Fund:

- To scale last-mile delivery and boost adoption of ORA Cash, its mobile wallet solution.

- ORA operates:

- Kooul – a fast-growing food delivery app.

- ORA Cash – a flexible digital wallet for payments and money transfers.

- Founder Omar Alami said the deal signals growing investor confidence in Morocco’s tech ecosystem.

Lebanon Enters the Entrepreneurial Media Scene

- The Lebanese version of Shark Tank officially launched on LBCI:

- Offers local entrepreneurs real-time investor access and the potential to secure funding.

- Produced in partnership with Different Productions, with open applications via email and phone.

- A cultural milestone that may inspire broader entrepreneurial engagement despite Lebanon’s economic challenges.

Substack Joins the Unicorn Club: A Global Case Study for Content Monetization

- US-based Substack raised $100M, reaching a $1.1B valuation.

- Expanded its platform to include audio, livestreaming, and interactive features such as “Notes”.

- The move reflects rising demand for paid, creator-led content and the global rise of independent media ecosystems.

- The company rebounded after scaling back operations in 2023, proving resilience and strong investor belief in its model.

Top Sector Trends: July 13–20, 2025

| Sector | Activity Count | Total Funding (Est.) |

| Fintech | 3 | $10M+ (combined) |

| Alternative Finance | 1 | $100M (targeted) |

| Artificial Intelligence | 1 | $1.5M |

| E-commerce / Logistics | 1 | $7.5M |

| Media & Ecosystem | 1 | N/A |

Analytical Takeaways and Forward Outlook

- Saudi Arabia continues to dominate the regional startup narrative, combining funding with infrastructure and ecosystem development.

- Fintech remains the most active sector across MENA, particularly solutions that blend digital finance with behavioral incentives.

- Arabic AI is an emerging force with global potential, especially in voice, dialects, and enterprise applications.

- Media entrepreneurship and platform-led funding models (e.g., Shark Tank Lebanon) may spark new investment interest in underserved markets.

- Content monetization models, as exemplified by Substack, highlight untapped opportunities for Arabic-language digital platforms.

العربية (Arabic) To read the article in Arabic, click here