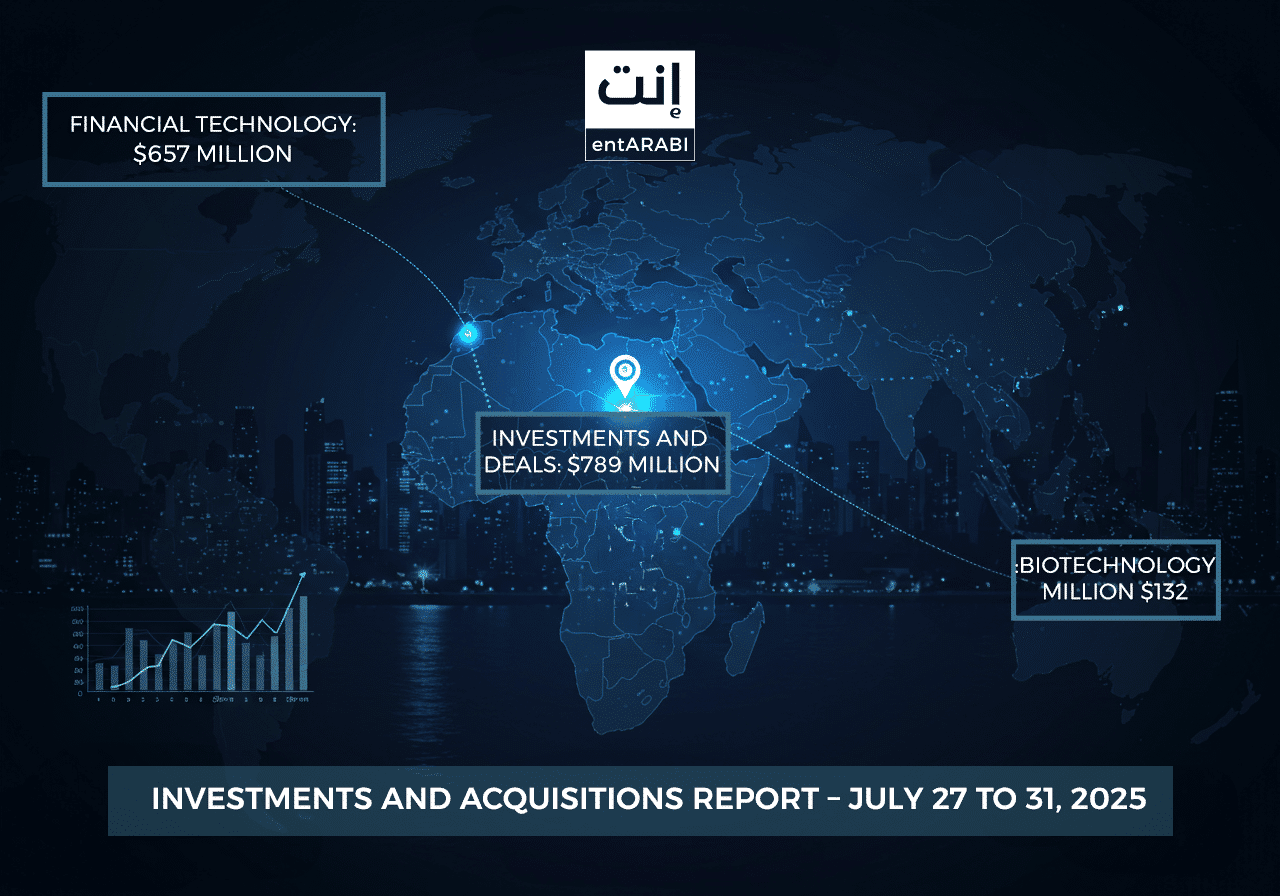

Between July 26 and 31, 2025, announced startup investments and acquisitions totaled $789 million, with the lion’s share going to the fintech sector, followed by biotech and AI-driven logistics technologies.

The UAE and Qatar emerged as the top investors during this period, driving high-profile deals in U.S. and global markets, while Saudi Arabia led regional operational activity and acquisitions.

This edition of the Startup Investment Report by “entArbi” highlights the week’s most notable deals and investment trends, offering insights into sectoral and geographic distributions that hint at the direction of the second half of the year.

Investments by Sector

-

Fintech & Open Finance Infrastructure: $657 million (83% of total deal value) – including Plaid and Mesh funding rounds led by UAE-based CE-Ventures.

-

Biotechnology: $132 million (17% of the total) – Series B round for Artbio, led by Qatar Investment Authority (QIA).

-

AI-Driven Logistics Tech: Undisclosed – Seed round for Jordan-based Olivery.

-

Restaurant Tech & Embedded Fintech: Undisclosed – Kuwait’s Kamco Invest acquired a stake in Saudi-based Foodics, as part of a planned $100 million investment strategy.

Investments by Country (Investor Location)

| Country | Disclosed Value | Notable Deals |

|---|---|---|

| UAE | $657M | Plaid, Mesh |

| Qatar | $132M | Artbio |

| Kuwait | — | Stake in Foodics |

| Jordan | — | Olivery (regional investors) |

UAE Takes the Lead in Fintech

The UAE captured the majority share of this week’s investment value through CE-Ventures’ funding of U.S.-based Plaid and Mesh.

These deals reflect a growing Emirati interest in strategic partnerships with global financial infrastructure providers, aiming to boost capabilities in lending, payments, and digital asset transactions.

Qatar Bets on Advanced Biotech

Qatar Investment Authority (QIA) reinforced its commitment to cutting-edge medical innovation by backing Artbio, a U.S. company specializing in targeted radiopharmaceutical therapies.

The deal marks Doha’s strong entry into the promising intersection of life sciences and human health.

Saudi Arabia Expands Regionally

Saudi-based Foodics attracted a strategic investment from Kuwait’s Kamco Invest, although the deal value was undisclosed.

The move comes as part of Foodics’ preparation for an upcoming IPO on Tadawul, following record H1 2025 performance and a roadmap involving expansion through fintech and AI acquisitions.

Jordan Focuses on Smart Logistics

Jordan’s Olivery is building AI-based solutions for last-mile delivery, offering predictive planning and proactive support.

The Seed round, backed by Innovest Fund and Flat6Labs Mashreq, signals the rise of smart logistics as a growing investment magnet across the region.

| Company | HQ | Sector | Deal Value | Deal Type | Investors/Entities |

|---|---|---|---|---|---|

| Plaid | USA | Fintech | $575M | Funding | CE-Ventures, others |

| Mesh | USA | Blockchain/Payments | $82M | Funding | CE-Ventures |

| Artbio | USA | Biotechnology | $132M | Series B | QIA, Sofinnova, B Capital |

| Spare | KSA/UAE | Open Finance Infrastructure | — | Initial License | Central Bank of the UAE |

| Foodics | Saudi Arabia | Restaurant Tech | — | Partial Acquisition | Kamco Invest |

| Foodics | Saudi Arabia | Restaurant Tech / Fintech | — | H1 Financial Results | — |

| Olivery | Jordan | Smart Logistics | — | Seed | Innovest Fund, Flat6Labs Mashreq |

Deal Summary Table (July 26–31, 2025)

العربية (Arabic) To read the article in Arabic, click here