The Middle East and North Africa witnessed remarkable investment activity between September 1 and 30, 2025, reflecting growing appetite from regional and global investors toward startups, particularly in FinTech, artificial intelligence (AI), and digital infrastructure.

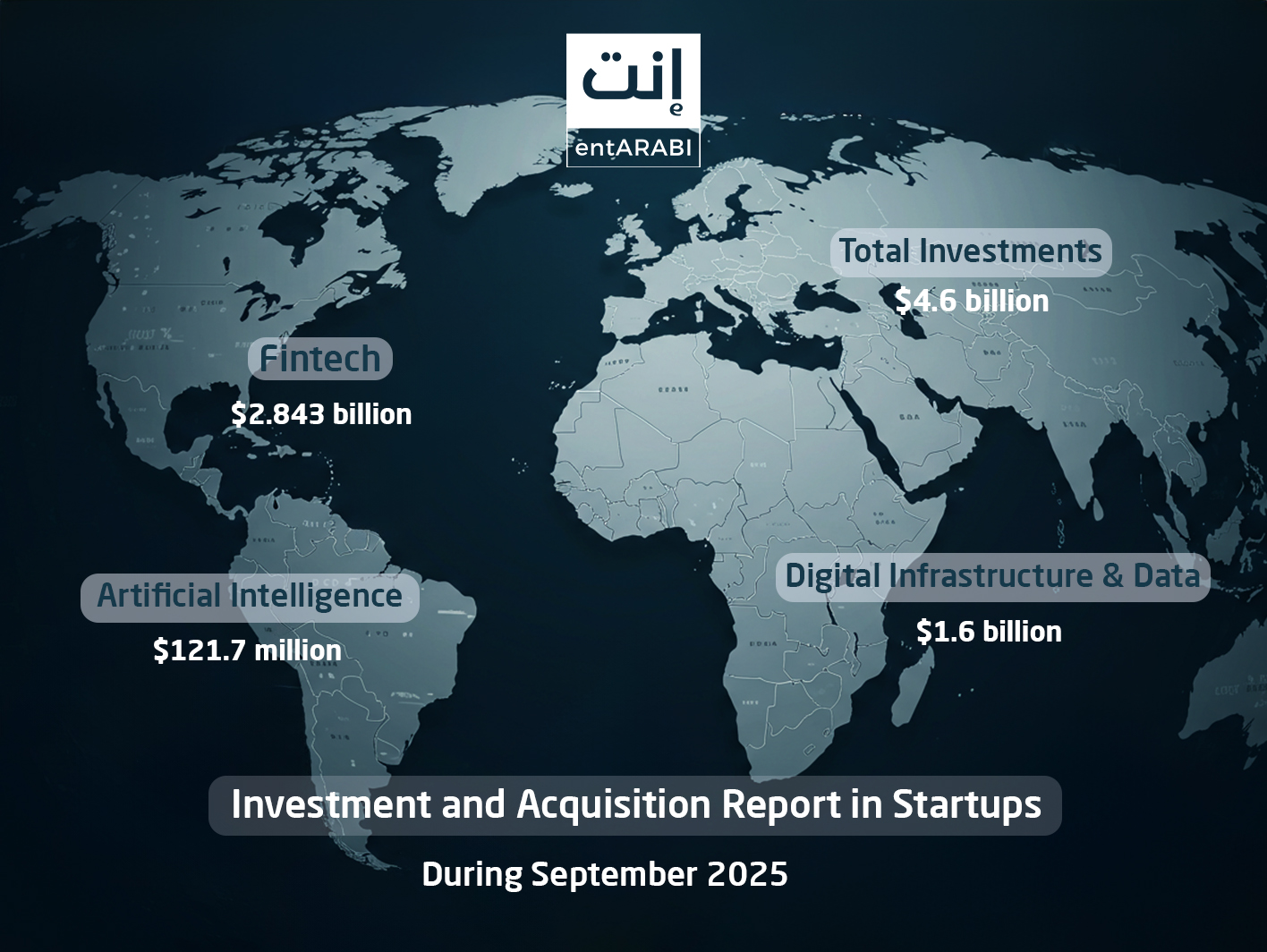

According to the monthly report issued by “entArabi”, titled “Investments and Acquisitions in Startups across the Middle East and Africa”, the total disclosed value of deals in the region reached approximately $4.6 billion, spread across 37+ announced transactions.

On the global front, transactions with Arab participation exceeded $63 billion, led by the Qatar Investment Authority (QIA) and a record-breaking acquisition deal by a Saudi-led consortium targeting global gaming giant EA.

Investments and Acquisitions by Country (Sept 1–30, 2025)

| Country | Total Investment (USD Million) | No. of Deals/Startups |

|---|---|---|

| Saudi Arabia | 2,853.5 | 18+ |

| United Arab Emirates | 1,614.3 | 4+ |

| Qatar | 100.0 | 1 (fund) |

| Oman | 7.5 | 1 |

| Morocco | 3.1 | 2 |

| Tunisia | 4.0 | 1 |

| Egypt | 3.5 | 3+ |

| Bahrain | 6.0 | 2 |

| Jordan | 1.55 | 1 |

| India (UAE-led) | 7.7 | 1 |

| Total | ≈4,601.15 | 37+ |

The September 2025 landscape highlighted Saudi Arabia and the UAE as the regional growth engines, while Qatar strengthened its position as a global player.

Investments and Acquisitions by Sector (Sept 1–30, 2025)

| Sector | Total Investment (USD Million) | No. of Deals |

|---|---|---|

| FinTech | 2,842.35 | 10+ |

| Digital Infrastructure / Data | 1,600.0 | 2 |

| Artificial Intelligence (AI) | 121.7 | 3+ |

| Investment Funds / VC | 111.0 | 3 |

| Mobility / Car Rentals | 12.5 | 1 |

| Logistics / Consumer | 2.5 | 2 |

| Hospitality / Short Stays | 1.8 | 1 |

| E-commerce | 1.0 | 1 |

| Supply Chain / PropTech | 0.5 | 1 |

| Total | ≈4,693.35 | 37+ |

Key Highlights of September 2025

Saudi Arabia

Led the regional scene with landmark deals such as Tamara ($2.4 billion), HALA ($157 million), and Intella ($12.5 million, AI sector).

United Arab Emirates

Featured prominently with the Abu Dhabi Investment Authority (ADIA) investing $1.6 billion in Vantage Data Centers, alongside WheelsOn ($12.5 million).

Qatar

Launched a $100 million fund, in addition to QIA’s participation in Anthropic’s $13 billion global funding round.

Egypt

Recorded notable moves including Munify ($3 million) and the acquisition of EXMGO by Dawaya.

Morocco & Bahrain

Expanded presence with deals in e-commerce (Justyol) and FinTech (Fintologya, Speer).

Emerging Themes

FinTech & AI Dominance

Together, FinTech and AI accounted for over 60% of the total announced deal value, driven by record-breaking rounds in Saudi Arabia.

Saudi Arabia at the Forefront

The Kingdom captured more than half of the region’s total disclosed value (≈$2.85 billion), thanks to mega FinTech and digital transformation deals.

Rise of Digital Infrastructure

The UAE consolidated its role as a regional hub, with multi-billion-dollar investments in data infrastructure.

Arab Participation in Global Mega-Deals

Both Qatar and Saudi Arabia reinforced their global stature with strategic investments in U.S. giants like Anthropic and EA.

Transparency Challenges

A significant portion of deals remain undisclosed, especially in early-stage funding (Pre-Seed), suggesting actual capital inflows are likely higher than published figures.

العربية (Arabic) To read the article in Arabic, click here