The second week of October 2025 witnessed a diverse wave of investment and acquisition activity across the Middle East, ranging from early-stage funding rounds to major government financing programs and large-scale international investments.

This report is part of the weekly “EntArabi” series, which tracks startup investments and acquisitions across the Middle East and North Africa region.

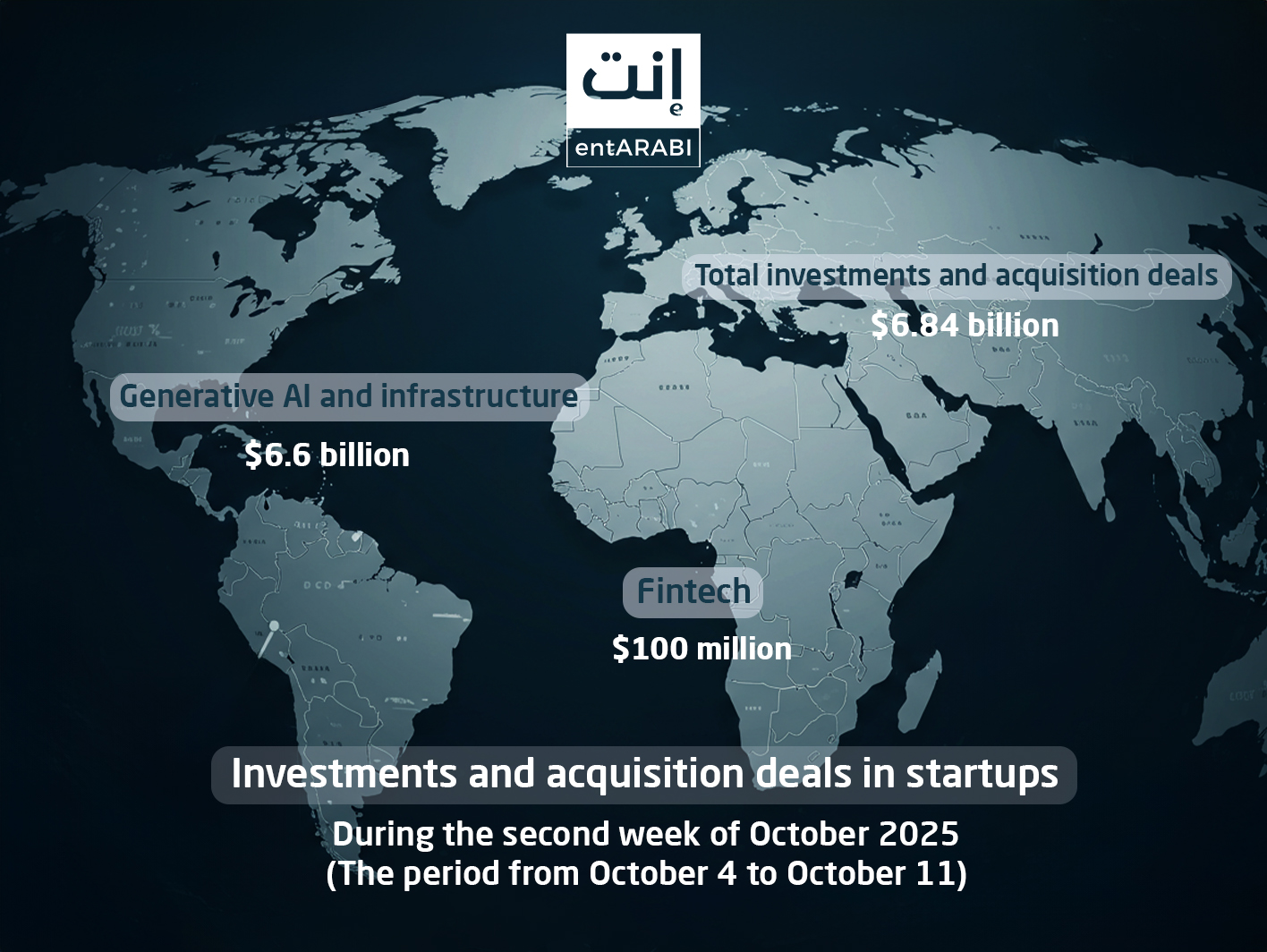

Total Activity Overview

The total value of announced deals during the week reached $6.85 billion, spread across seven major transactions, led by the $6.6 billion investment by UAE-based MGX in the U.S. company OpenAI — marking one of the region’s most significant deals in the last quarter of the year.

Investments and Acquisitions by Country

| Country / Entity | Number of Deals | Total Value (USD Million) |

|---|---|---|

| Saudi Arabia (Oqood, Nuxera AI, Everbridge Capital, Engagesoft) | 4 | 107 |

| United Arab Emirates (Emirates Development Bank Program) | 1 (National Program) | 136 |

| United States (OpenAI – MGX UAE Investment) | 1 | 6,600 |

| Turkey (Touché Privé) | 1 | 5 |

| Total | 7 | 6,848 |

Investments by Sector

| Sector | Number of Companies / Programs | Total Value (USD Million) | Notes |

|---|---|---|---|

| Generative AI & Infrastructure (OpenAI) | 1 | 6,600 | MGX UAE’s secondary share investment in OpenAI. |

| Entrepreneurship Support & Financing (EDB) | 1 (Program) | 136 | UAE’s national initiative to support startups and SMEs. |

| Fintech (Everbridge Capital) | 1 | 100 | New fintech fund launched in Riyadh with $100M capital. |

| HealthTech (Nuxera AI) | 1 | 2.5 | Pre-seed round for developing Arabic AI healthcare solutions. |

| Fashion & E-commerce (Touché Privé) | 1 | 5 | Sharia-compliant growth funding to expand in GCC markets. |

| LegalTech (Oqood) | 1 | 1 | Seed round led by Sanabil, part of Saudi PIF. |

| HRTech & Enterprise Solutions (Engagesoft) | 1 | 3.5 | Pre-Series A round to enhance employee engagement via AI. |

| Total | 7 | 6,848 | — |

Key Highlights

Major International Deals:

MGX’s $6.6 billion investment in OpenAI accounted for the majority of total deal value this week, underscoring the growing influence of Gulf capital in the global AI landscape.

Saudi Arabia Leads in Deal Volume:

Saudi Arabia topped the list in terms of deal count, with four transactions totaling over $107 million, signaling a rising momentum in local tech investments — particularly in AI and fintech sectors.

Diverse Investment Sectors

Investments spanned seven key sectors, including AI, fintech, legaltech, healthtech, fashion, HR solutions, and entrepreneurship support, reflecting the region’s growing innovation and diversification in the startup ecosystem.

UAE as a Global Startup Hub

The $136 million financing program launched by the Emirates Development Bank reinforces the UAE’s institutional commitment to nurturing entrepreneurship and its ambition to position itself as a global capital for startups.

العربية (Arabic) To read the article in Arabic, click here