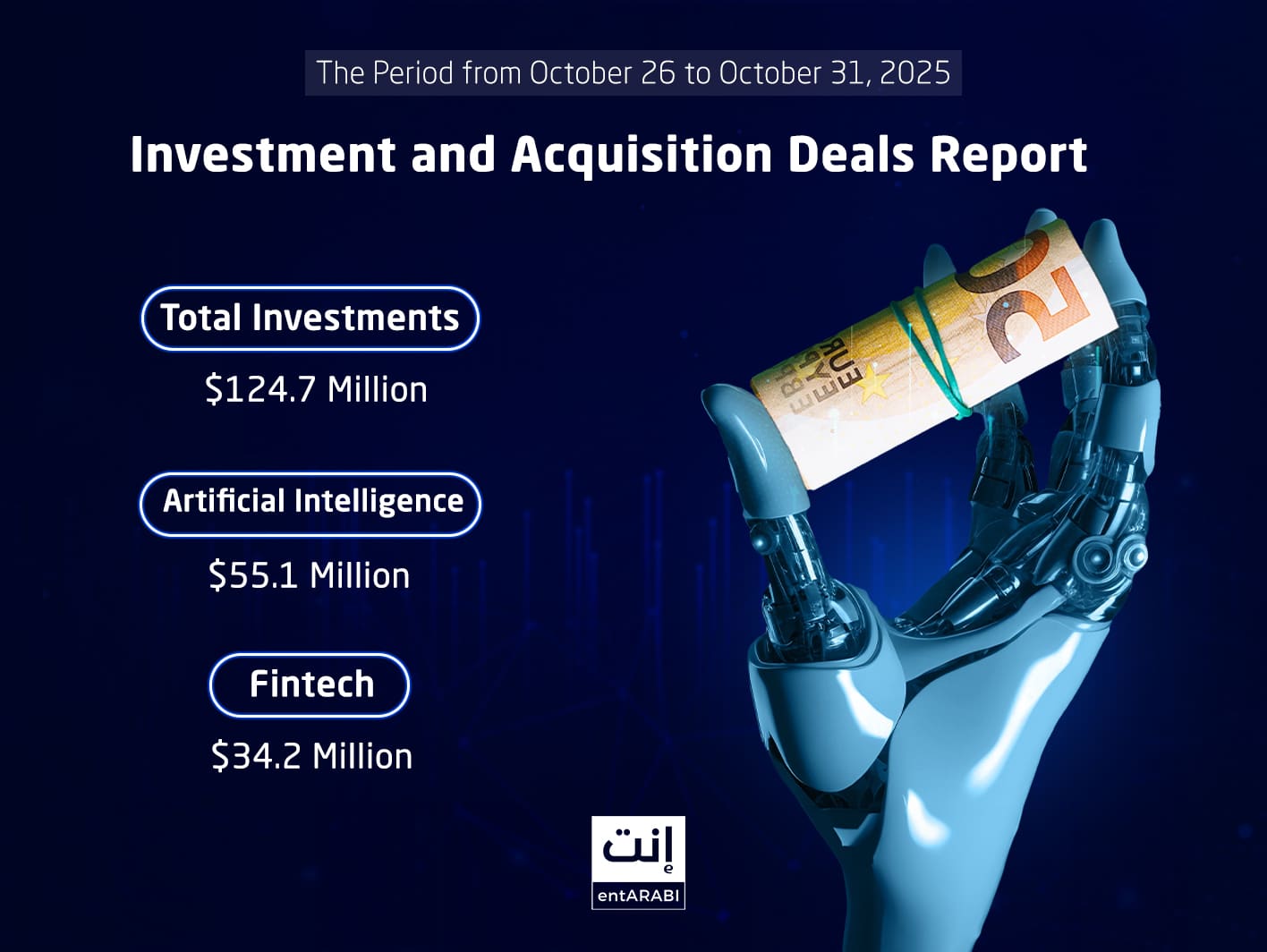

- Weekly Report: Startup Investments Reach $124.7 Million Across 11 Deals

- AI Sector Leads with $55.1 Million in 4 Deals

- Saudi Arabia Dominates Regional Startup Funding and Deal Activity

Startups across the Middle East and the Arab world recorded strong investment and acquisition activity during the period from October 26 to 31, 2025, driven by growing momentum in AI applications, digital infrastructure, and logistics solutions.

According to entArabi’s latest report, Saudi Arabia continued to lead the region in both deal volume and funding value, followed by the UAE, while FinTech, AI, and logistics emerged as the most attractive sectors for investors.

The data reflects sustained investor confidence in AI-driven and digital transformation sectors, with Saudi Arabia maintaining a dominant position fueled by Vision 2030 and its national megaprojects. Meanwhile, the UAE continues to attract large-scale institutional technology funding, and African markets show increased reliance on acquisitions over greenfield expansions to accelerate growth.

Key Deals in Saudi Arabia

Wated Medical: Closed its Pre-Seed round, led by Riyadh Angel Investors, to expand digital ambulance and home healthcare services.

Logexa: Raised $2 million (Pre-Series A) from Seedra Ventures and Nour Nouf Ventures to enhance its logistics and smart warehousing platform.

Squadio: Secured SAR 11 million ($3 million) in a Pre-Series A round led by Wa’ed Aramco, Sanabil 500, and Sidra Ventures, to expand its remote tech hiring operations regionally and globally.

Najeeb.ai: Closed a Pre-Seed round with local angel investors to develop AI solutions tailored for the insurance sector.

BRKZ: Raised $30 million from Stride Ventures to accelerate its growth in the building materials market and optimize supply chains.

PIF & Aramco – HUMAIN: Signed a non-binding agreement granting Aramco a minority stake in HUMAIN to develop national AI capabilities and position Saudi Arabia as a global technology hub.

Key Deals in the UAE

UnifyApps: Raised $50 million in a round led by WestBridge Capital and Iconiq, to develop an enterprise AI operating system that integrates data and workflows in a secure, multilingual environment.

Qaws.ai: Acquired Samas Gamify, a behavioral assessment startup using gamification, to launch an AI-powered recruitment platform combining data analytics, educational verification, and intelligent candidate matching.

Diverse Tech Investments: From Banking to Creative AI

MidLyr: Closed a $2.5 million Pre-Seed round led by Silicon Badia with global VC participation (Wedbush Ventures, Hustle Fund, DCG), to automate banking operations using AI and reduce operational risks.

rmz.ai: Raised $100,000 (Pre-Seed) from Beyond.xyz to develop “Creative Agents,” generative AI tools for content production.

Velents.ai (Saudi Arabia): Secured $1.5 million from investors at Google and BCG while launching Agent.sa, an Arabic-speaking AI employee for corporate use.

Tabby Strengthens FinTech Leadership

Tabby, the leading “Buy Now, Pay Later” platform, strengthened its regional dominance after a secondary share sale that raised its valuation to $4.5 billion, without issuing new shares — a sign of strong investor confidence and readiness for a potential future IPO.

African Expansion Through Acquisition

Logidoo (Morocco) acquired Kamtar (Côte d’Ivoire), backed by Toyota Tsusho, to strengthen its logistics network across West Africa.

The deal highlights Africa’s growing trend toward “acquisition over build” strategies to accelerate operational and technological expansion.

Startup Investments by Sector (Nov 26–31, 2025)

| Sector | Number of Deals | Total Funding (USD) | Key Companies |

|---|---|---|---|

| AI & Enterprise Tech | 4 | 55.1M | UnifyApps – Velents.ai – HUMAIN – Qaws.ai |

| Logistics & Supply Chain | 2 | 32M | Logexa – Logidoo |

| FinTech | 2 | 34.5M | Tabby – MidLyr |

| Digital Healthcare | 1 | N/A | Wated Medical |

| Creative Content & Media | 1 | 100K | rmz.ai |

| Tech Talent & HR | 1 | 3M | Squadio |

| Total | 11 Deals | ≈124.7M USD | — |

Startup Investments by Country (Nov 26–31, 2025)

| Country | Number of Startups | Total Funding (USD) | Notable Deals |

|---|---|---|---|

| Saudi Arabia | 6 | 64.6M | BRKZ – HUMAIN – Squadio – Najeeb.ai – Velents.ai – Wated Medical |

| UAE | 2 | 50M | UnifyApps – Qaws.ai |

| Morocco / West Africa | 1 | 2M (Acquisition) | Logidoo – Kamtar |

| Jordan / Regional | 1 | 2.5M | MidLyr |

| Other (Content Platforms) | 1 | 100K | rmz.ai |

| Total | 11 Startups | ≈119M USD | — |

العربية (Arabic) To read the article in Arabic, click here