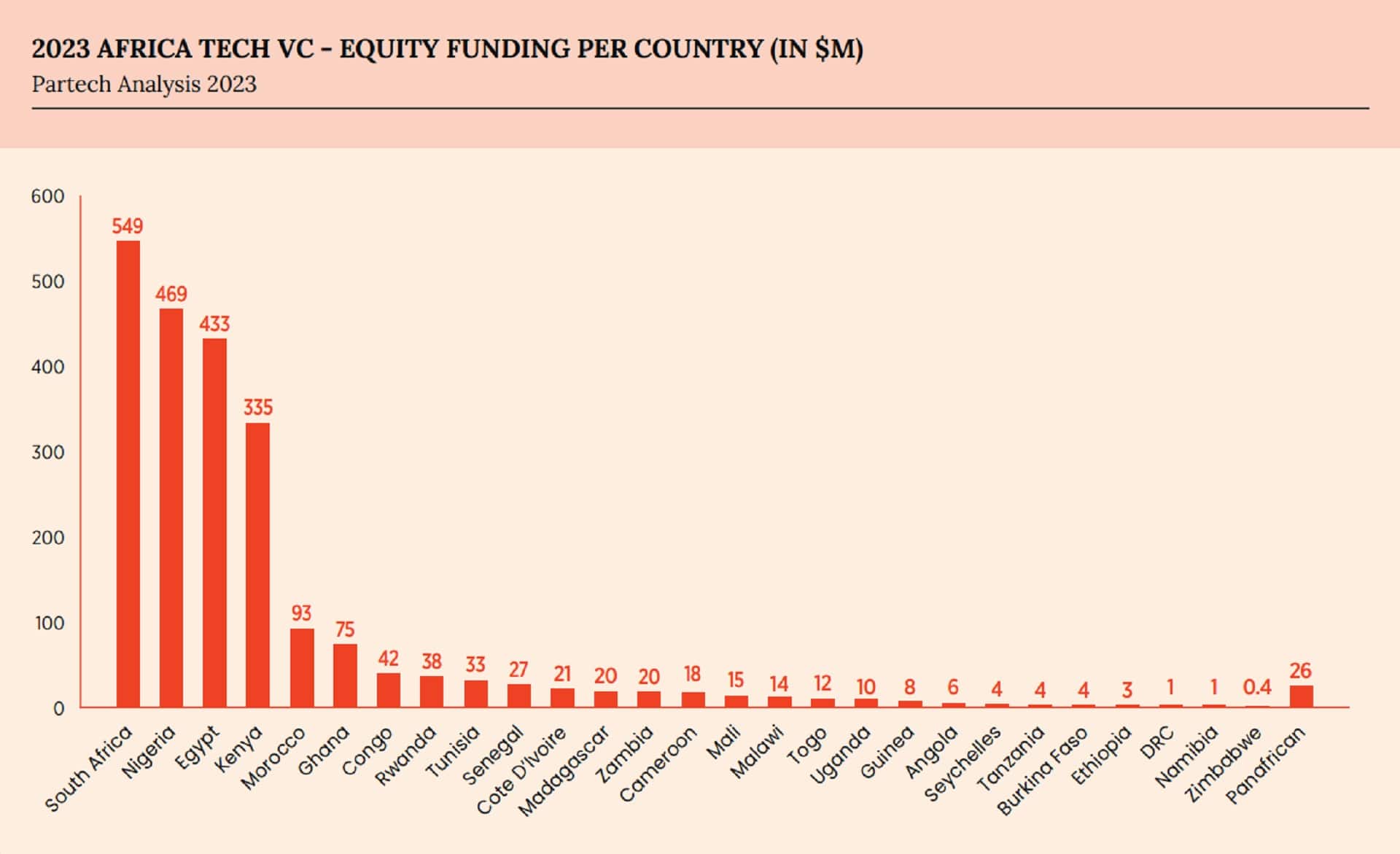

Attracting technology venture capital is no easy feat, and Egypt is no exception. Last year, Egypt ranked third in Africa in terms of attracting technology venture capital, based on the volume and value of deals announced, according to the annual report by Partech, the global venture capital company. South Africa topped the list in value with a total investment of $549 million across 83 deals, followed by Nigeria with $469 million through 111 deals, and Kenya in fourth place with a total investment of $335 million across 67 deals.

Globally, venture capital funding for companies saw a 35% decline worldwide in 2023 to reach $345 billion, according to data from PitchBook, a research company. The year saw poor performance across various levels, with each quarter recording fewer deals than the preceding quarter. North America led the scene in terms of deal volume and value during the year, with a total of 14.4 thousand deals amounting to $179.1 billion, followed by Asia with 11.3 thousand deals valued at $91.1 billion, and finally Europe with 9,400 deals worth $61.9 billion.

In Egypt, technological deals witnessed a significant decline, with their number dropping by 58% to 60 deals, and their value decreasing by about 45% annually to reach $432 million. However, this figure did not accurately reflect the actual decline, as one deal accounted for about 60% of the total, which was the financing raised by EMNT with a value of $260 million through the sale of shares, in addition to issuing $140 million in bond notes.

The financial technology sector accounted for 70% of venture capital funding in Egypt last year, taking into account the impact of the EMNT deal on the figures. Meanwhile, the healthcare technology sector accounted for about 10% of total funding, followed by the e-commerce and software sectors.

Regarding the African continent, the four major countries (South Africa, Nigeria, Egypt, and Kenya) accounted for the majority of venture capital funding for the technology sector, with 79% of the total deal value, up from 68% in the previous year. Despite dominating the market, there was a “significant decrease in funding due to the challenges prevailing in the market.” Nigeria and Kenya saw a 59% and 56% decline, respectively, in stock purchase financing, while South Africa recorded a better performance with only a 34% decline.

The top four countries remain at the top, having accounted for all venture capital deals to finance projects in the growth stage, indicating that investors prefer to “focus on the larger and more famous markets” in the current instability, according to the Partech report. The four countries include three of the “largest economies on the continent and the most consumer-oriented,” namely Egypt, Nigeria, and South Africa.

Venture capital funding declined amid the pressures it faced, as well as the individual economic challenges each country faced. These challenges include currency devaluation in Egypt and Nigeria, which contributed to “undermining the investment climate, leading to the closure of startups and a decline in investors,” according to Partech.

Among the new developments, investors began to shift their focus to injecting funds into Francophone countries, which “stand out with dynamic strength and witness growth in the technology sector contrary to market trends,” and are the only countries on the continent that saw annual growth in the number of deals and investor participation. Excluding the top four countries, Francophone countries accounted for 68% of the continent’s deals last year, up from 38% in the previous year. Congo, Morocco, Rwanda, Tunisia, and Senegal ranked among the top ten attracting venture capital funding in the technology sector in Africa, highlighting the attractiveness and growing potential of these markets in the technology sector.

العربية (Arabic) To read the article in Arabic, click here