The startup ecosystem in the Middle East and North Africa (MENA) witnessed diverse activity throughout July 2025, with notable funding rounds and acquisitions across key sectors including FinTech, logistics, real estate, healthcare, and deep tech.

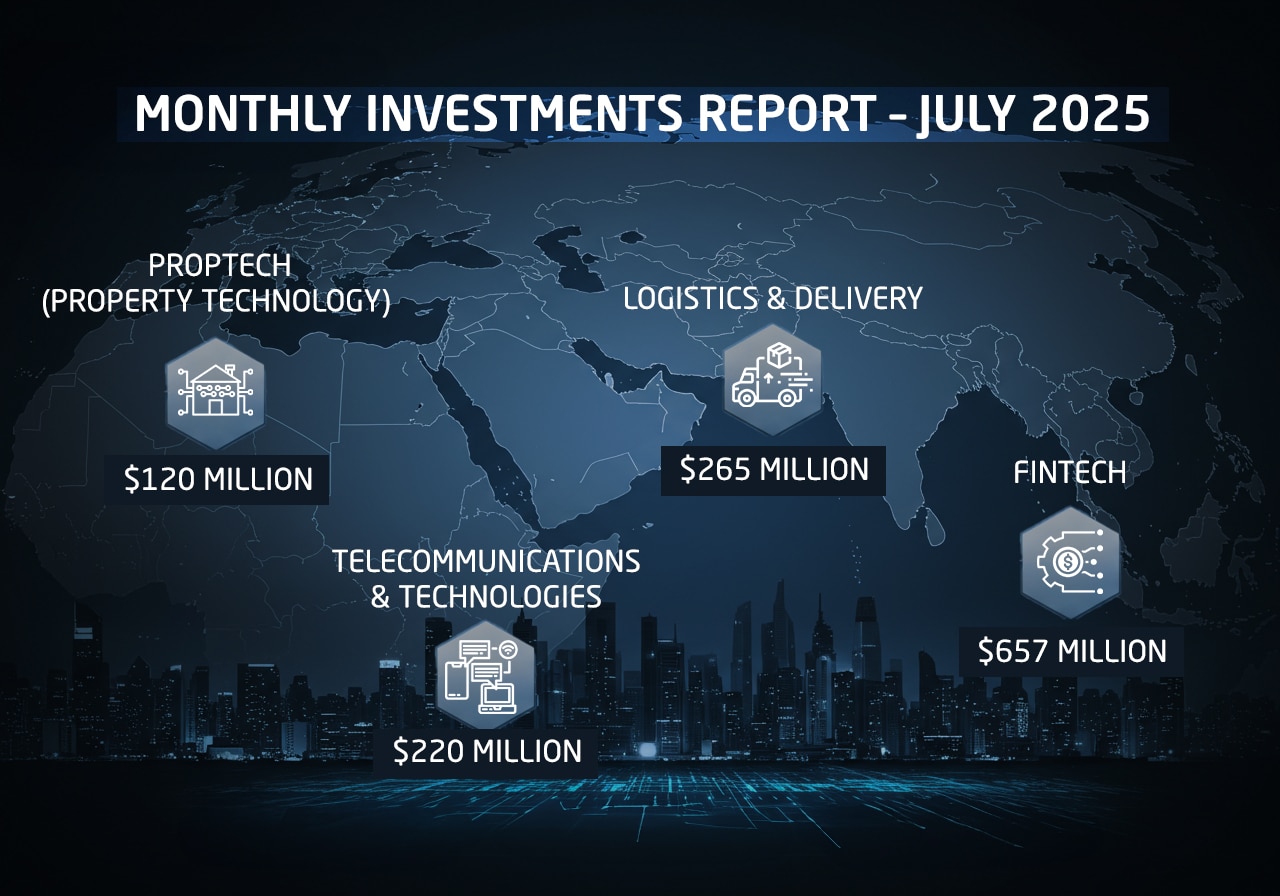

According to the Startup Investment & Acquisition Report for the Middle East and Africa published by entaArabi, the total value of disclosed and partially undisclosed deals in the region between July 1 and July 31, 2025, exceeded $1.25 billion.

This report provides a sectoral and geographical breakdown of the deals, highlighting key investment movements and emerging trends that defined the month.

1. Sector Breakdown of Startup Investments

| Sector | Estimated Investment Value | Key Companies / Deals |

| FinTech | $657M+ | Plaid, Mesh, Affinity Africa, Flend, Palm, Sahem |

| Logistics & Delivery | $265M+ | Ninja, Jahez–Snoonu, TruKKer, Olivery |

| PropTech | $120M+ | Huspy, Nawy – SmartCrowd |

| Telecom & Connectivity | $220M | Airalo |

| Biotech & Healthcare | $132M | Artbio, BioSapien |

| Artificial Intelligence | $3M+ | Wittify.ai, Journify, Bunyan |

| E-commerce & Payments | $7.5M | ORA Technologies |

| Agri/FoodTech | Undisclosed (Acceleration) | 13 startups via “Sunbolah” program |

| Alternative Finance & VC | $100M | Launch of Sukna Capital fund |

| Media & Digital Content | N/A | Launch of Shark Tank Lebanon (support initiative) |

2. Country-wise Breakdown of Investments

| Country | Estimated Investment Value | Key Sectors / Companies |

| UAE | $657M+ | Plaid, Mesh, Airalo, Huspy, SmartCrowd |

| Saudi Arabia | $450M+ | Ninja, Jahez–Snoonu, Sahem, TruKKer, Wittify, Huspy |

| Qatar | $132M | Artbio (via Qatar Investment Authority) |

| Egypt | $3M+ | Flend, Palm, Nawy, MINT Program |

| Oman | < $1M | ZabonEx |

| Jordan | Undisclosed | Olivery (AI-powered logistics) |

| Morocco | $7.5M | ORA Technologies |

| Ghana | $8M | Affinity Africa (FinTech) |

| Lebanon | N/A | Local launch of Shark Tank to support innovation |

| USA / Global | Referenced only | Plaid, Mesh, Artbio, BioSapien (with Arab VCs) |

3. Key Deals in July 2025

| Company / Program | Deal Type | Geography | Approx. Value | Investors / Notable Parties |

| Plaid | Funding | US / UAE Investment | $575M | CE-Ventures |

| Mesh | Funding | US / UAE Investment | $82M | CE-Ventures |

| Artbio | Series B | US / Qatar | $132M | QIA, B Capital |

| Plaid | Growth Round | Saudi Arabia | $250M | Riyad Capital |

| Airalo | Series B | Global / UAE | $220M | CVC Capital Partners |

| Jahez–Snoonu | Acquisition | Saudi / Qatar | $245M | Jahez |

| Huspy | Series B | UAE / Saudi | $59M | Strategic Investors |

| Nawy–SmartCrowd | Acquisition | Egypt / UAE | $52M | Nawy |

| TruKKer | Expansion Round | Saudi / UAE | $15M | STV, Riyad Capital, others |

| Wittify.ai | Seed Round | Saudi Arabia | $1M+ | Angel Investors |

| Palm | Seed Round | Egypt | Millions USD | 4DX Ventures, Plus VC |

| ORA Technologies | Seed Funding | Morocco | $7.5M | Launch Africa VC |

| Sahem | Pre-Seed Funding | Saudi Arabia | Undisclosed | Saudi Investors |

| Flend | Funding | Egypt | Undisclosed | Flat6Labs |

| Journify / Bunyan | Acceleration | Saudi Arabia | – | Part of Elevate AI Program |

4. Key Trends Observed in July 2025

- FinTech continues to dominate both in terms of deal count and total capital raised.

- Saudi Arabia leads the region’s funding and M&A activity, driven by aggressive initiatives from public and private investment arms.

- Cross-border investments are on the rise, particularly from UAE-based investors backing US startups.

- PropTech and HealthTech sectors are maturing, with growing acquisition interest.

- AI-powered startups are emerging across content creation, logistics, and finance.

- Acceleration programs such as Sunbolah in the Gulf and MINT in Egypt are playing a vital role in launching new startups.

العربية (Arabic) To read the article in Arabic, click here