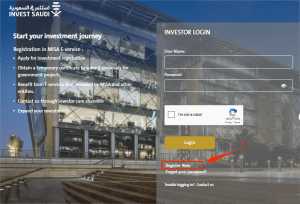

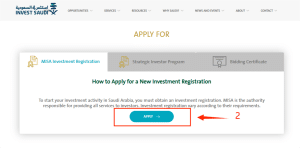

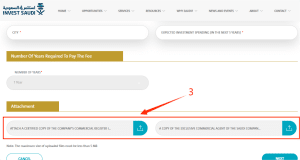

To establish a business presence in Saudi Arabia, foreign entrepreneurs and companies must first obtain an investment license from the Ministry of Investment of Saudi Arabia (MISA) — formerly known as SAGIA. This updated October 2025 guide provides a complete, step-by-step walkthrough of the MISA investment license in Saudi Arabia process, featuring real screenshots from the official MISA website to make every step clear and practical. From preparing the required documents and selecting your business activity to submitting your application and receiving final approval, you’ll find everything you need to confidently and successfully obtain your investment license in Saudi Arabia.

What Is an Investment License in Saudi Arabia?

An investment license in Saudi Arabia is a legal document that allows foreign investors and companies to operate in the Kingdom. Without this license, non-Saudi entities cannot register a business, own shares, or conduct commercial activities.

- Who needs it? Any foreign-owned business, whether a startup, SME, or multinational.

- Issuing body: Previously SAGIA, now MISA.

- Industries covered: Most sectors are open, though some industries (oil exploration, military, etc.) have restrictions.

This license is the first step to establishing a Commercial Registration (CR) with the Ministry of Commerce.

SAGIA vs. MISA — What Changed?

- SAGIA’s role (pre-2020): Served as the regulator for foreign investment.

- Rebranding to MISA (2020): Under Vision 2030, SAGIA became the Ministry of Investment of Saudi Arabia.

- What’s new with MISA:

- Broader authority as a government ministry.

- More investor-friendly processes.

- Alignment with Saudi’s diversification strategy beyond oil.

In short, MISA is simply the modern version of SAGIA with a stronger mandate to attract global investors.

Requirements for Obtaining the License

Applicants must meet certain requirements and provide documentation. These typically include:

- For individuals: Valid passport, business plan, financial capability proof.

- For companies:

- Articles of Association.

- Commercial registration from the home country.

- Board resolution approving the Saudi entity.

- Translations: All documents must be in Arabic (certified translations required).

- Sector-specific approvals: For industries like healthcare, education, or fintech, extra approvals may apply.

Step-by-Step Process to Apply for an Investment License in Saudi Arabia

- Create an account on the official MISA portal.

- Submit an application form online, selecting the desired business activity.

- Upload required documents (company registration, financials, etc.).

- Pay government fees through the online system.

- Wait for review & initial approval (usually within 2–4 weeks).

- Obtain the license from MISA.

- Proceed with company registration (CR) at the Ministry of Commerce.

- Complete secondary registrations: municipality license, GOSI (social insurance), Zakat/Tax registration.

This process is mostly digital, but investors may need to visit Saudi Arabia for notarization or final approvals.

Costs and Timelines for Saudi Investment License

| Type of Fee / Service | Amount (SAR) | Frequency / Notes |

|---|---|---|

| License Fee | 2,000 SAR | Paid yearly, up to a maximum of 5 years |

| Investor Relations Center Subscription (First Year) | 10,000 SAR | One-time fee for the first year to access MISA Investor Relations services |

| Investor Relations Center Subscription (Following Years) | 60,000 SAR | Annual subscription fee starting from the second year |

| Payment Deadline | Within 60 days of bill issuance | If payment is delayed, the service will be cancelled and a new application must be submitted |

Read Also: How to Create a Successful Marketing Campaign: 10 Steps + Case Study

Common Challenges and How to Overcome Them

- Incomplete documentation: Always prepare certified copies and Arabic translations.

- Industry restrictions: Check if your sector is open to 100% foreign ownership.

- Delays in approvals: Work with local consultants to fast-track processes.

- Understanding regulations: Laws may differ for LLCs, joint ventures, or branch offices.

Tips for a Smooth Application

- Partner with a local business consultancy or law firm.

- Double-check that all documents are notarized and attested.

- Keep a clear business plan aligned with Saudi Vision 2030.

- Track applications via the MISA portal to avoid delays.

Benefits of Getting an Investment License in Saudi Arabia

Obtaining this license opens several doors for investors:

- 100% Foreign Ownership – No need for a local Saudi partner in most sectors.

- Profit Repatriation – Investors can transfer profits abroad without restrictions.

- Access to Government Projects – Eligible to participate in public tenders.

- Recruitment Flexibility – Ability to sponsor and hire foreign employees.

- Strategic Market Entry – Gateway to GCC and Middle East markets.

This makes Saudi Arabia one of the most liberalized investment destinations in the region.

Frequently Asked Questions (FAQ)

Q1: Can foreigners own 100% of a business in Saudi Arabia?

Yes, in most sectors, MISA allows 100% ownership.

Q2: Is SAGIA still valid or only MISA?

SAGIA no longer exists; MISA is the official authority since 2020.

Q3: What is the minimum capital requirement?

This varies by sector. Some activities require no minimum, while others (like industrial) may require higher capital.

Q4: Can I apply remotely?

Yes, the MISA portal supports online applications, but some steps may require physical presence.

By following the step-by-step guide with screenshots provided above, you’ll be able to navigate the requirements confidently and ensure full compliance with Saudi regulations. Once your license is approved, you can legally establish your business, open bank accounts, hire employees, and take advantage of the many incentives offered under Saudi Vision 2030.