- BECO Capital closes two new funds (a fourth fund and a growth fund), bringing total assets under management to over $820 million.

- $120M early-stage fund for Pre-Seed to Series A startups, and a $250M growth fund for later-stage companies up to pre-IPO.

- Investments target fintech, proptech, contech, consumer solutions, and AI-driven technologies.

BECO Capital, one of the leading venture capital firms in the Middle East, announced the closure of two new investment funds worth $370 million. With this milestone, BECO’s total assets under management (AUM) now exceed $820 million, reinforcing its position as a key VC player across the UAE and Saudi Arabia.

Fourth Fund: $120M for Early-Stage Startups

BECO Capital launched its fourth fund (BECO Fund IV) with $120 million dedicated to early-stage startups, from Pre-Seed through Series A.

The fund will back high-potential companies across key verticals:

-

Fintech (financial technology)

-

Proptech (real estate technology)

-

Contech (construction technology)

-

Consumer and retail solutions

-

Software and artificial intelligence

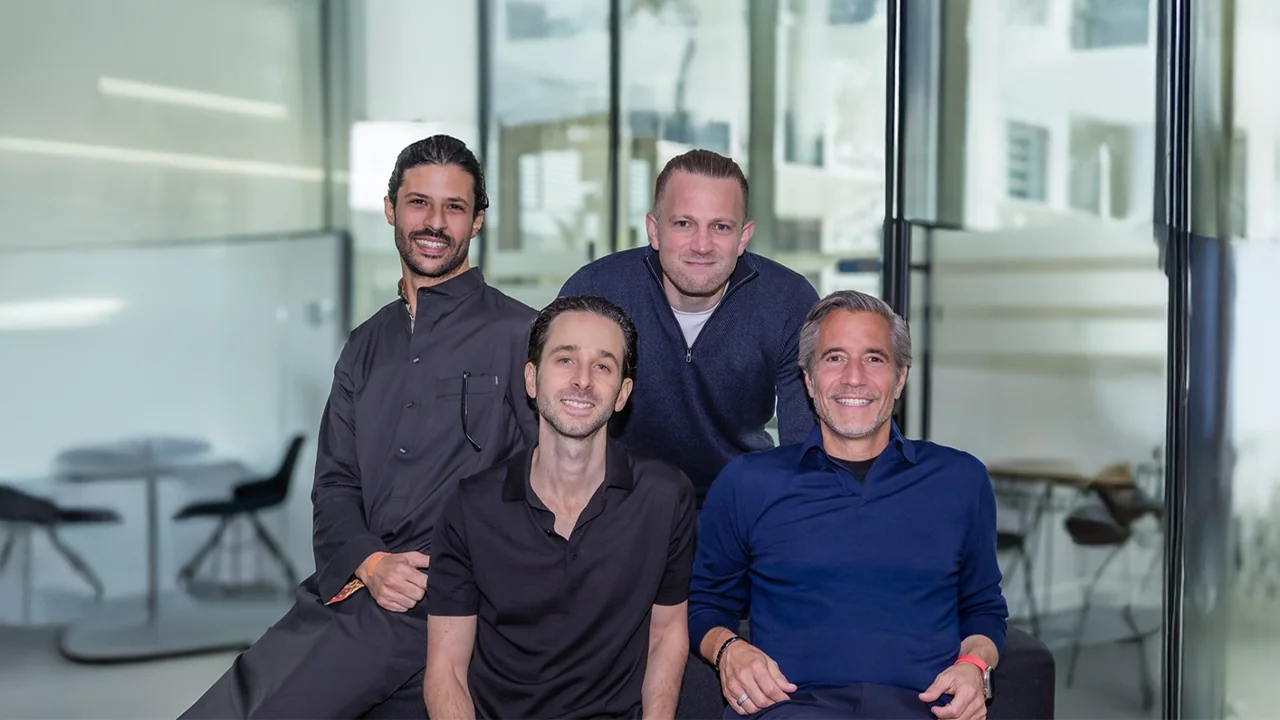

The fund is led by managing partners Dany Farha, Abdulaziz Sheikh El Saghah, and Youssef Hammad, who bring extensive expertise in guiding founders through their toughest early stages.

Dany Farha, Co-Founder and Managing Partner at BECO Capital, stated:

“The launch of this fund reflects our strong conviction in the opportunities in the UAE and Saudi Arabia, and our belief in the local talent driving the region’s technological transformation.”

Growth Fund: $250M for Scaling Startups

Alongside Fund IV, BECO Capital introduced a $250 million growth fund to support companies from Series B to pre-IPO stages. Led by General Partner Amer Alaily, the fund will make investments of up to $20 million per company, targeting both BECO’s existing portfolio and new ventures with strong regional expansion potential.

Alaily commented:

“Gulf startups are growing at a rapid pace but still face funding gaps at advanced stages. This fund enables us to bridge that gap, helping leading companies scale regionally and achieve successful exits.”

A Comprehensive VC Platform for the Gulf

By launching these two funds, BECO Capital now provides a full-spectrum venture capital platform, supporting founders from their earliest funding rounds to eventual IPOs. This positions BECO as one of the most influential VCs in the Gulf, particularly in the UAE and Saudi Arabia, where tech innovation is accelerating at an unprecedented pace.